According to AAA, 61% of car buyers are considering purchasing another vehicle because their current vehicle is no longer reliable or safe to drive (65%) or it needs costly repairs (45%). When considering purchasing a vehicle (new or used), it's important to understand all costs associated with owning and operating a car monthly and annually.

Ownership Costs

Ownership costs are based on the vehicle's financing, owning and driving it for five years, and then trading that vehicle in at the end of five years. The total cost of ownership is the sum of the following four categories:

- Depreciation: The difference between what the vehicle was purchased for and eventually sold/traded in for. It is the amount of money "lost" as the vehicle's value diminishes over ownership time.

- Financing: The amount paid in interest on the loan used to purchase a vehicle.

- Insurance: The cost of a full-coverage policy for a driver with at least six years of driving experience.

- Fees: These are all government taxes and fees due upon purchase and fees due each year, such as registration.

Operating Costs

The operating costs for a vehicle are the ongoing expenses incurred from the regular day-to-day use of your car.

- Fuel: The cost of fueling a vehicle, whether gasoline, diesel, or electricity. Fuel prices, fuel economy, miles driven, and driving style (city versus highway) will affect this cost.

- Maintenance: This includes routine maintenance, unexpected repairs, and tire replacements.

Electrification

Electric vehicles (EVs) do not require as much maintenance as gas-powered cars since they do not need oil changes, air-filter replacements, and simple powertrains. However, due to their comparatively high purchase prices, EVs rank second-highest in fees, depreciation, and finance costs (behind only ½-ton pickups), and they have the highest insurance costs of any category. EVs have the lowest fuel cost of any vehicle type, based on a national average electricity price of 15.9 cents per kilowatt hour (kWh).

Hybrids

The cost of driving hybrid cars is second lowest behind small sedans. They benefit from excellent fuel economy, ranking second lowest in fuel costs behind only EVs. They have the third lowest maintenance costs and depreciation and rank near the middle in fees, financing, and insurance costs!

Let’s Dive Deeper!

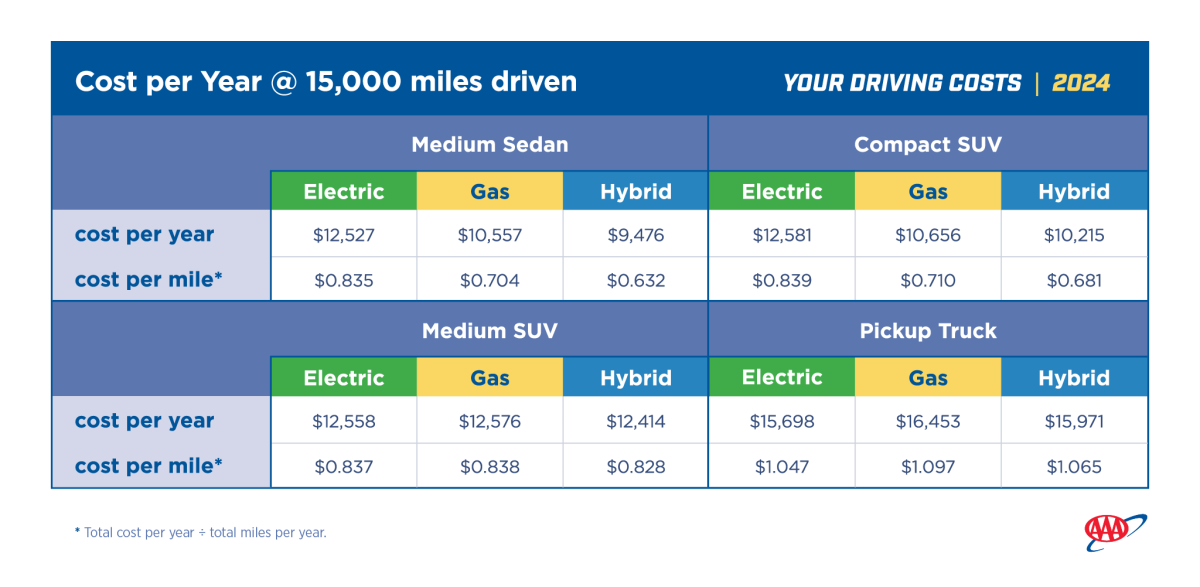

New this year, AAA is adding a new special section to Your Driving Costs, which compares top-selling electric, hybrid, and traditional gas models in four popular vehicle categories (medium sedan, compact SUV, ½ ton pick-up, and medium SUV). This bonus analysis will give consumers a snapshot of ownership costs for select hybrid and EV models compared to their gas-powered counterparts.

Hybrid vehicles are a reasonable, affordable option for those who want to try the benefits of electrification due to their low fuel, maintenance, depreciation, and insurance costs. AAA’s analysis shows they are the least expensive to own and operate in each vehicle category.

Budget Tips & Buying Advice

If you do not have to buy a car right now, it is better to hold off. In most cases, it is less expensive to maintain/repair your current vehicle than to negotiate purchasing a new or used car.

While it may be tempting to trade in or sell your current vehicle because of its high valuation, you will use that equity to purchase a new or used vehicle, which essentially becomes a zero-net gain. Here’s how to buy a car without tanking your budget:

Typically, three negotiations occur when purchasing a vehicle: the cost of the car, the finance rate, and the trade-in value. Keep each transaction/negotiation separate from the others.

- The Purchase Cost: Check multiple websites, including the manufacturer, to see what the vehicle sells for in your area. Also, remember that groups like AAA may offer discounts for membership. Research to understand what a "good deal" is for the vehicle you are interested in. You could save hundreds of dollars by driving outside your immediate location and expanding your search area.

- Hot Tip: Remember to factor in an increase in your car insurance payments and a monthly budget due to auto loan interest rates when creating your budget. Once you narrow your vehicle choices down to two or three, it's good practice to call your insurance company and obtain a quote for each vehicle.

- The Finance Rate: Your credit score is the most significant factor in obtaining a favorable interest rate. Higher credit scores will result in lower interest rates. Obtain pre-approval for an auto loan, determine the highest interest rate you might be charged, and then ask the dealer if they can offer a lower interest rate. If they can, you save money.

The Trade-In Value: You must determine the vehicle's condition while evaluating your trade-in. Most used vehicles fall into the "good" or "fair" category. Check various websites to learn the average trade-in value for your vehicle. Remember, selling a vehicle yourself may increase the value you can get. However, there are safety aspects to consider, such as proper paperwork, bill of sale, etc. Trading in the vehicle can often be more straightforward and hassle-free.

Treat a car purchase as a business decision, not an emotional decision. It's too easy to get caught up in the "new car smell" and lose focus. You should have a budget and stick to it. Additionally, you should buy the car you want, not necessarily the vehicle the salesperson wants you to buy.

Car Buying Survey Methodology

The survey was conducted September 21-25, 2023, using a probability-based panel designed to be representative of the U.S. household population overall. The panel provides sample coverage of approximately 97% of the U.S. household population. Most surveys were completed online; consumer without Internet access were surveyed over the phone.

A total of 1,191 interviews were completed among U.S. adults, 18 years of age or older. The margin of error for the study overall is +/- 4% at the 95% confidence level. Smaller subgroups have larger error margins.