The popular saying, “It’s not what you earn, but what you spend that matters,” perfectly highlights the importance of budgeting and money management. Applying budgeting tips that help you save and spend less can significantly increase the worth of your income.

By following financial basics like prioritizing needs, building a savings account and reducing costs with memberships, you can become more financially savvy and accomplish your goals. And the sooner you apply these tips when you start earning, the better!

The Benefits of Budgeting

Learning how to organize finances and manage your spending can help you:

- Gain better financial awareness: You can gain invaluable financial knowledge if you start budgeting when you start earning and remain consistent with it. The longer you budget, the more likely you are to be aware of price hikes, interest rates, investments, memberships, premiums and other financial factors that affect your cash flow.

- Increase control over your spending: Burning through your income is very possible when you aren't aware of how much you spend compared to how much you have. Knowing how much you can allocate to various expenditures gives you greater control over your finances. You become aware of what you can afford and what you should put on hold or cut out of your spending altogether.

- Accomplish your goals: Having a budget can be like a fast track to accomplishing your financial goals. Yes — you will still have to save, make sacrifices and be patient while you accomplish those goals, but a budget makes it more achievable. You can also be well on your way to financial freedom when you include debt repayments, savings and investments in your budget.

- Build a safety net: One of the most powerful parts of having a budget is how it prepares you for the future, whether it's grocery spending for the month ahead or buying a new car. By budgeting when you start earning, you can even save for your future home and retirement.

- Have greater peace of mind: Budgeting gives you peace of mind that your finances are sufficient to cover your needs and emergencies. When you are sticking to your budget, there isn't the worry of unexpected expenses. It also gives you the drive to know you can make more of your goals possible.

Budgeting and Money Management Tips

Managing your personal finances and investing in your future is one of the most rewarding experiences. Planning and saving allow you to start your journey to financial freedom. Applying these money management strategies and tips can make budgeting simpler and more effective:

Create a Solid Budget

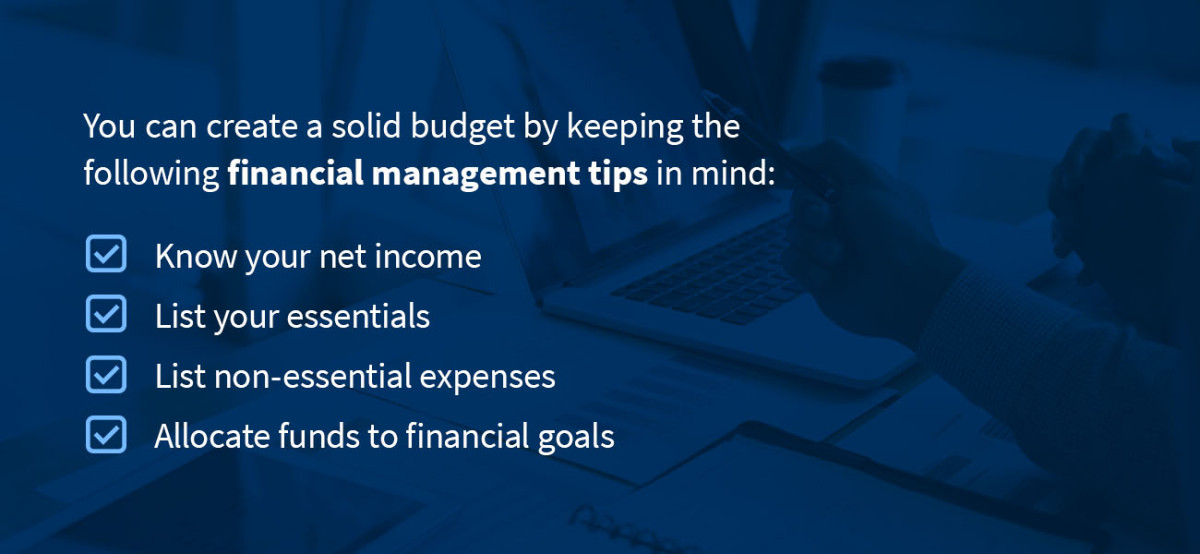

Your budget is part of the foundation of managing your finances. Having a simple plan tailored to you is essential. You can create a solid budget by keeping the following financial management tips in mind:

- Know your net income: Calculate your net income, which is what you have left after deductions. Note this amount on your budget. It may also help you to note your gross income separately from your net and list all your deductions so you are aware of your salary breakdown.

- List your essentials: Note your essential expenses. These include groceries, rent, rates, your utilities like your energy and phone bills, transportation costs, insurance payments, credit card or debt repayments and — if you have children — all child care costs. Tally the amount and deduct it from your net income. This way, you know how much you have left for savings, investments and discretionary expenses.

- List non-essential expenses: For many earning people, it would be unrealistic to say you have no non-essential or discretionary expenses. It is important to list these expenses honestly in your budget rather than pretending they do not exist. Discretionary expenses include coffee, dining out and takeout, travel, entertainment like subscription services and hobbies and luxury items like electronics and designer clothes.

- Allocate funds to financial goals: Your budget should also include the amount you would like to save or invest every month to accomplish your financial goals.

Stick to Your Budget

Creating a budget is one thing — sticking to it can be quite another! There are a few ways you can make it easier to commit to your budget:

- Use cash over the card: Did you know that you are twice as likely to spend more money when you shop using a card over cash? Your chance of impulse buying also doubles when you use a card over cash.

- Focus on prioritizing needs to meet your goals: Being careful with your money is not always easy. You may need to sacrifice a few of your comforts, but living below your means is what will help you achieve your financial goals.

- Prioritize wants by saving for them: While the aim of your budget is to focus on essentials, it doesn't have to all be about sacrifice — at least, not permanently. By sacrificing small non-essential items every day or every month — coffee and eating out — you save for the big luxuries that make a difference to the quality of your life, like traveling.

- Automate your savings: If you find it difficult to commit to saving or paying your debts, you may try automating these payments to ensure they are a steady part of your monthly budget.

- Take advantage of budgeting tools: Using online budget tools or a budgeting app may make it easier for you to create your budget and stay on track.

Take Advantage of Memberships

Having the right memberships can be a powerful financial tool. They can provide you with essential services and cost-saving benefits. With a membership association like AAA, you can enjoy discounts and save money on gas and travel. You also enjoy vital services at competitive rates, like roadside assistance and auto repairs, insurance and financial options like savings accounts and even driver's training.

Keep Reviewing Your Financial Goals

The amazing part about your budget is that it is flexible and grows with you. The budget you create when you first start earning won't be the budget you follow when you start hitting money goals and growing your finances. But no matter how you adjust your budget as you review your income and goals, it should remain a part of your financial journey — it will always continue serving you.

Enjoy Cost-Saving Membership Benefits From AAA Central Penn

AAA Central Penn offers excellent auto insurance membership plans that help you to take further control of your finances. We provide services like auto loans and insurance, roadside assistance and discounts that let you save on gas and travel. Sign up or upgrade your membership today!